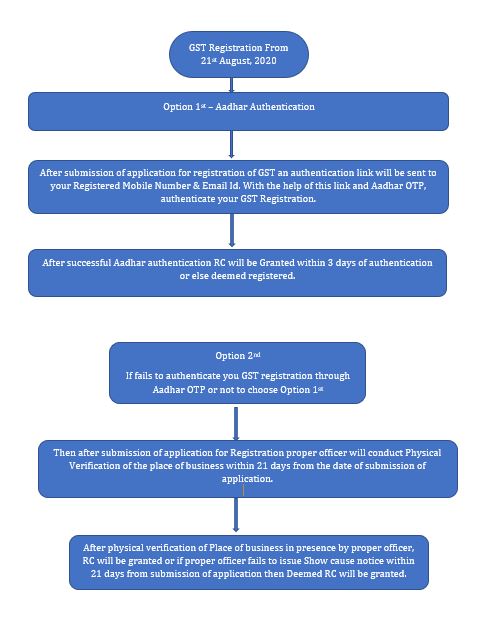

GST Registration - Authentication Procedure

Notification No.: 62/2020-Central Tax

Effective from 21st August,

2020

Aadhar

Authentication for GST Registration

Where an applicant, other than notified

u/s 25(6D), opts for authentication for Aadhar number, he shall, while submitting

application under sub rule (4), with effect from 21st August, 2020,

undergo authentication of Aadhar number and the date of submission of the

application in such cases shall be the date of authentication of the Aadhar

number, or fifteen days from the submission of the application in Part-B of

Form GST REG-01 under sub-rule (4), whichever is earlier.

Where person fails to Aadhar

authentication

Provided that where a person, other than

a person notified u/s 25(6D), fails to undergo authentication of Aadhar number

as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhar

number, the registration shall be granted only after physical verification of

the place of business in the presence of the said person, in the manner

provided under rule 25.

Provided further that the proper

officer may, for reasons to be recorded in writing and with the approval of an

officer not below the rank of Joint Commissioner, in lieu of the physical

verification of the place of business, carry out the verification of such

documents as he may deem fit

Provided that where a person, other

than a person notified u/s 25(6D), fails to undergo authentication of Aadhaar

number as specified in sub-rule (4A) of rule 8 or does not opt for

authentication of Aadhaar number, the notice in FORM GST REG-03 may be issued

not later than twenty one days from the date of submission of the application.

If the proper officer fails to take

any action

(a) within a period of three working

days from the date of submission of the application in cases where a person

successfully undergoes authentication of Aadhaar number or is notified under

subsection (6D) of section 25; or

(b) within the time period prescribed

under the proviso to sub-rule (2), in cases where a person, other than a person

notified under sub-section (6D) of section 25, fails to undergo authentication

of Aadhaar number as specified in sub-rule (4A) of rule 8; or

(c) within a period of twenty-one

days from the date of submission of the application in cases where a person

does not opt for authentication of Aadhaar number; or

(d) within a period of seven working

days from the date of the receipt of the clarification, information or

documents furnished by the applicant under sub-rule (2), the application for

grant of registration shall be deemed to have been approved.

Comments

Post a Comment